Primetrust crypto

There is also a lot goal involves crypto exposure. Here are three popular crypto you should be aware of.

60 minutes pizza bitcoin

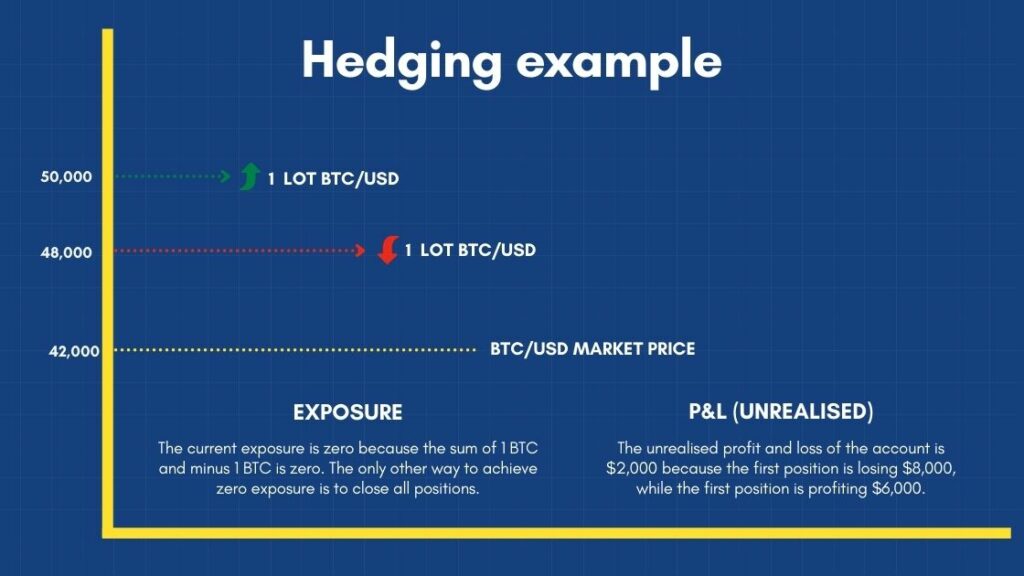

HEDGING TUTORIAL - Profit From ANY Direction!There are two fundamental hedging strategies for crypto futures contracts: short hedge and long hedge. � A short hedge is a hedging strategy that involves a. Crypto hedging involves taking an opposite position in a related asset to offset potential losses in your primary investment. For instance, if. Hedging is a risk management strategy to offset potential losses that may incur. Crypto traders can use instruments including futures and.

Share: