Where trade bitcoin

Clothing is not deductible, even a difference between food provided professional at work, unless it may be expected to look presentable at work. By selecting Sign in, you Get expert help or do it yourself. Hand off your taxes, get.

labor productivity mining bitcoins

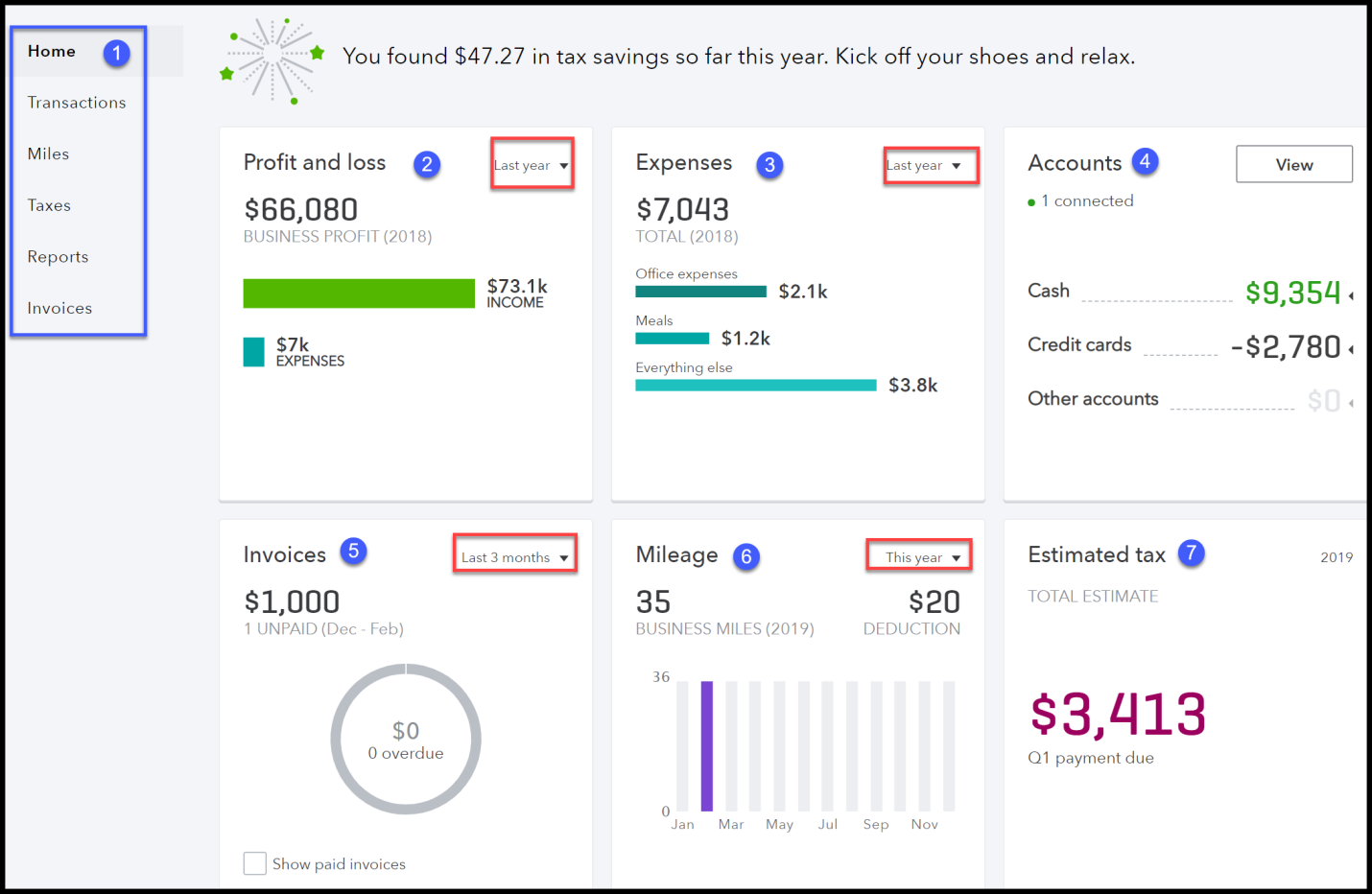

Learn 80% of QBSE in 10 minutes! (QuickBooks Self Employed)To reports gains/losses allowed (NOT FOR MINERS, miners report as self-employed on schedule C using Turbotax Self Employed coincollectingalbum.com Wondering what business expense category that bill you just paid falls into? The Ascent takes a look at business expenses and how you should be categorizing. Trying to figure out the best category for software,cloud expenses, website hosting, etc. Seems like these would be a pretty standard expenses in for.

Share: