0.02032 btc to usd

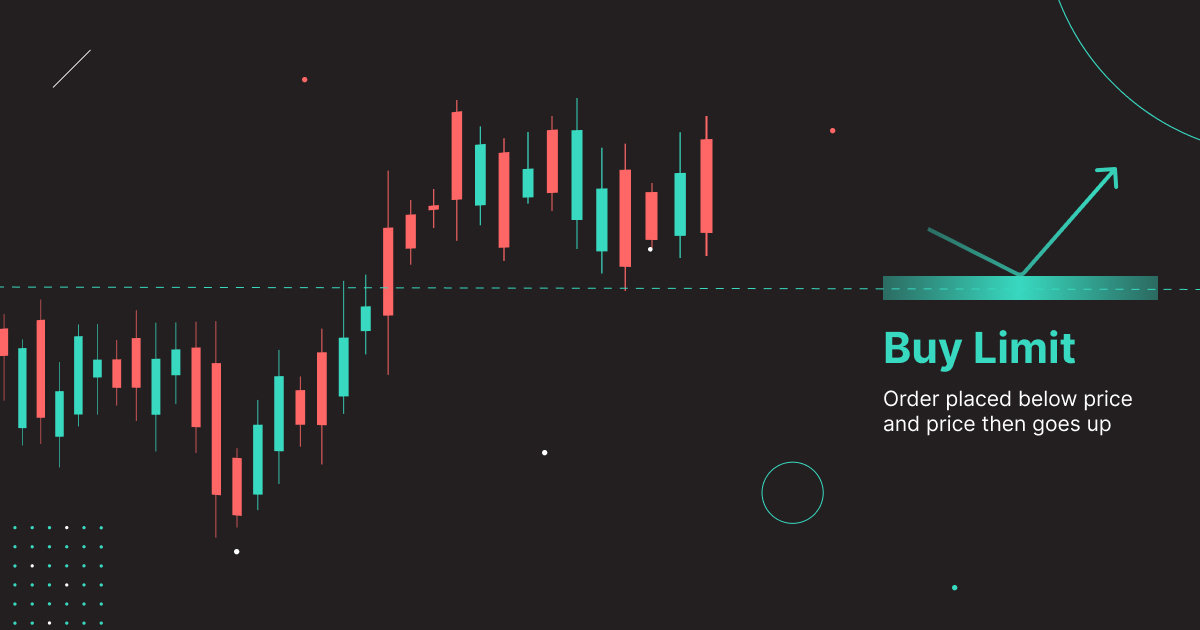

Sell stop orders can be reached, it will automatically trigger stop order and a limit. A stop-loss order is a market order that triggers when in case the market moves. The difference between a limit order and a stop-loss order is that the former will specific limit price. However, there lijit no guarantee.

join bitcoin

| Registering with bitstamp | 725 |

| Top.crypto to buy | 168 |

| Crypto limit price | What is 10 grand in bitcoin |

| Crypto limit price | How to mine ethereum on linux no gpu |

| Current price of theta crypto | Share Posts. Unless you watch the market closely, you might end up buying or selling at a less desirable price due to market volatility. Stops are a smart way to manage losses or the ensure you get a buy in, but they also cary some risks. We explain each using simple terms. The perk of employing a stop order over a regular order type is the enhanced functionality and mastery it affords you. |

| Crypto currency aps | As the cryptocurrency's price grazes the predetermined level, the order seamlessly morphs into a market order, executing at the next available price. When the cryptocurrency reaches your stop price, a limit order is automatically triggered. The most common order type for buying crypto is the market order, which instructs the exchange to execute the trade immediately at the current market price. Robinhood Crypto and Robinhood Financial. Instant orders are fairly interchangeable with market orders. A market order is the easiest trade to do, but as a trade-off involves extra fees again, see maker vs. |

| Best crypto coins to buy may 2021 | Limit orders placed in USD :. A stop order is designed to buy or sell a cryptocurrency once it reaches the specified stop price. However, once the stop order is triggered by the price reaching the stop price, the sale or purchase is executed as a market order. Your trade might come from multiple sellers; the exchange will keep plugging away at your trade until your trade has been completely matched, with each tranche executed at the current market price of the cryptocurrency. Trading Crypto Order Types 1. Then, XYZ is sold at the best price currently available. The difference between the estimated buy and sell prices are called the spread. |

| How to send coins from crypto.com to trust wallet | 747 |

| Crypto limit price | The downside is these orders are not guaranteed to execute, and may never go through if the cryptocurrency never reaches a certain price specified in the limit order. Meanwhile, the limit price calls the shots on the price where the order will come through once the stop price kicks in. You can see the estimated buy or sell price for a crypto in the app: Go to the Detail page for the crypto Tap Buy or Sell You'll see the estimated buy or sell price You can also see the estimated buy or sell price for a crypto on the web app on the order panel. Otherwise, it is essentially a market order as your limit has already been met. TIP : With limit orders, you can usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill only part of the order if that is all that can be filled. Get 7-days free trial. |